ACCRETIVPLUS TI NOTE LIMITED

ISIN No.: SC4188IEFC6027

Ticker Code: ACCBond1

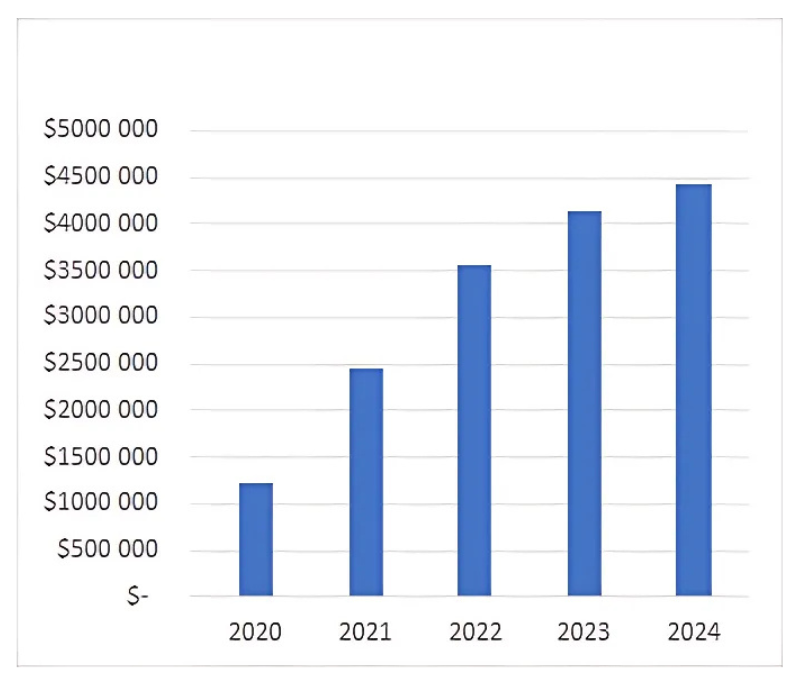

AccretivPLUS (ACCPLUS) is raising these notes exclusively for the improvement of the underlying real estate of the Company, to advance its goal of growing the value of its portfolio of healthcare buildings.The portfolio consists of 24 buildings, valued at over $200 million, spanning nine states in some of the fastest-growing cities and counties across the U.S. It is fully leased to over 100 healthcare providers, with an occupancy rate of 93% and an average lease term exceeding 5 years. Combined distributions now are more than $1m per quarter and growing as illustrated in the graph on the right-hand side of your screen.

AccretivPLUS underlying buildings have senior debt in the capital stack sourced mostly from traditional banks. Most of these loans enjoy exceptionally low rates of interest because of the time that the rate was fixed on acquisition of the building.

It would make sense to raise additional debt from these institutions for purposes of installing new tenants, extending existing tenants or undergoing renovation or improvement of the buildings. This would result in the full loan undergoing a restructure aligning with current interest rates. In some instances, this would result in an increase in the interest on the senior debt from 3% to 7%.

AccretivPLUS is raising these notes exclusively for the improvement of the underlying real estate of the Company, to advance its goal of growing the value of its portfolio of healthcare buildings.

How It Works

Notes will be issued on the 1st of each month, provided that funds are received before the 20th of the preceding month. The simple interest of 9% per annum will accrue monthly but be capitalised annually. There is a 1-year lock-in period. The full value of the capital and accrued interest can be withdrawn anytime thereafter with 90 days' notice.

Security & Collateral

The AccretivPLUS TI Note is backed by a portfolio of medical commercial real estate exceeding $200 million in value with over $80 million invested equity, providing investors with structured risk-adjusted returns in a resilient asset class.

Highlights

WANT MORE INFORMATION?

ORBVEST.com is a website (the “ORBVEST Platform”) operated by OrbVest SA (Pty) Ltd, an authorised financial services company (registration Number 50483) ("OrbVest") and represents AccretivPLUS Health Care Portfolio Limited in offering this product to investors. By accessing this site and any pages on it, you agree to our Terms of Use and Privacy Policy. OrbVest does not give investment advice, nor does it endorse, analyse or recommend the sale or trade in securities. The information contained in the platform should not be construed as advice unless specifically referred to as "Advice". The content on the OrbVest Platform does not constitute an offer by OrbVest to sell, solicit or buy an investment. Offers to sell or buy a security can only be made through official offer documents, e.g. a subscription agreement and private placement memorandum.

Before deciding to invest in any investment opportunity described on this platform, potential investors are advised to scrutinise carefully all accompanying documentation. Any investment overview found on the OrbVest platform is intended merely to summarise the potential investment and is not intended to be a complete description of it. That description can only be found in the official documentation. Investments, projections and other forward-looking statements on the OrbVest platform do not constitute promises of future returns. They are not statements of fact and OrbVest cannot guarantee that they are accurate or complete. There is no duty upon OrbVest to update any forward-looking statement to conform with actual results. OrbVest urges potential investors to consult with their tax, legal and financial advisers before making any investment.

Direct and indirect purchase of physical property involves significant risk. The value of investments may decline, and Investors must be able to afford to lose their entire investment. Additionally, while shares are publicly traded on the MERJ exchange, they are illiquid, are subject to holding period requirements, and are intended for investors who do not need a liquid investment. The most sensible investment strategy for investment in real estate requires that it should form only a part of your overall investment portfolio.

PAST PERFORMANCE IS NO GUARANTEE OF FUTURE RESULTS

You access this platform at your own risk, and you are responsible for complying with all local laws, rules and regulations. We may restrict any person, geographic area or jurisdiction from accessing the platform.

These securities are listed securities on the regulated MERJ exchange, governed by the Financial Services Authority of Seychelles, under the sponsorship of PKF Capital.

In South Africa, OrbVest SA (Pty) Ltd is an authorized FSP (registration Number 50483). This website does not recommend, guide or propose that any product described on it is suitable for your financial needs. No information contained on this website should be construed, or relied upon, as advice. No information on this website is intended to provide, nor constitute, financial, tax, legal, investment or other advice. If you require financial and/or investment advice, please use an independent financial adviser.